Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Or resident for the year.

Tax Savings For 2020 3 Things You Must Do Now Before Year End Copy Yau Co

And ii PR No.

. Ad Quickly End IRS State Tax Problems. Bench Retro gets your books in order so you can file fast. Taxed under the Malaysian Income Tax Act 1967 MITA are taxed under the Labuan Business Activity Tax Act 1990 at 3 of audited net profits or may elect a fixed tax of MYR 20000.

Ad Owe back tax 10K-200K. See if you Qualify for IRS Fresh Start Request Online. Personal Income Tax Relief For Year Assessment of 2018.

If You Have IRS Issues No Matter How Big Embarrassing Or Scary Our Tax Pros Can Help. What You Need To Know About Income Tax Reliefs In Malaysia Lifestyle. Income tax relief on contributions for Employees Provident Fund EPF and payment for life insurance.

Click Now Find the Best Company for You. Ad Compare the Best Tax Relief Companies to Help You Get Out of Tax Debt. A non-resident individual is taxed at a flat rate of 30 on total.

62018 titled Taxation Of A Resident Individual Part III. Substantial tax savings are possible depending on their. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying.

Ad Our expert bookkeepers will help maximize your deductionsand limit your tax liability. Maximizing personal reliefs by an individual resident can result in a significant difference to the taxpayers taxes. Ad Quickly End IRS State Tax Problems.

If taxable you are required to fill in M Form. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means. This means that low-income earners are imposed with a lower tax rate compared.

Receiving tax exempt dividends. For expatriates that qualify for tax residency Malaysia has a progressive personal income tax system in which the tax rate increases as an individuals income increases starting. Take Avantage of IRS Fresh Start.

Self and dependent relatives. Compare the Top Tax Relief and Find the One Thats Best for You. These are the types of personal reliefs you can claim for the Year of Assessment 2021.

Separate Assessment Wife Husband-350 350-400 400. 20182019 Malaysian Tax Booklet 21 year and in any 3 of the 4 immediately preceding years he was in Malaysia for at least 90 days or was resident in Malaysia. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022.

Click Now Find the Best Company for You. Cost of basic supporting equipment for disabled individual self spouse child or parent RM6000. End Your IRS Tax Problems Today.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to. End Your IRS Tax Problems Today. Ad Compare the Best Tax Relief Companies to Help You Get Out of Tax Debt.

During the transitional period from 1 January 2022 to 30 June 2022 foreign-sourced income of tax residents remitted to Malaysia will be taxed at 3 on gross income. Owe IRS 10K-110K Back Taxes Check Eligibility. Self Dependent 9000 2.

As the total amount of personal reliefs claimed by Mrs Chua exceeds the overall relief cap of 80000 the total personal reliefs allowed to her is capped at 80000 for YA 2018. Get Instant Recommendations Trusted Reviews. 52018 titled Taxation Of A Resident Individual Part II Computation of Total Income and Chargeable Income.

Avoid the hefty tax penalties. Get Your Qualification Analysis Done Today. Year Of Assessment 2001 - 2008 RM Year Of Assessment 2009 Onwards RM a.

Ad See the Top 10 Tax Relief. You can get up to RM2500 worth of tax relief for lifestyle expenses under this category. Take Avantage of IRS Fresh Start.

The following is the summary of tax measures for Malaysia Budget 2019. Personal income tax rates. Get Your Qualification Analysis Done Today.

Medical expenses on serious diseases including complete. Types of Contribution allowed for Personal Tax Relief Individual Relief Types Amount RM 1. Purchase of personal computer for individual allow once in 3 years RM3000 Resident individual in Malaysia entitles to claim tax relief deduction and rebate Tax Relief Tax Deduction Housing.

Ad Our Tax Pros Can Work With The IRS So You Dont Have To From Start To Solution.

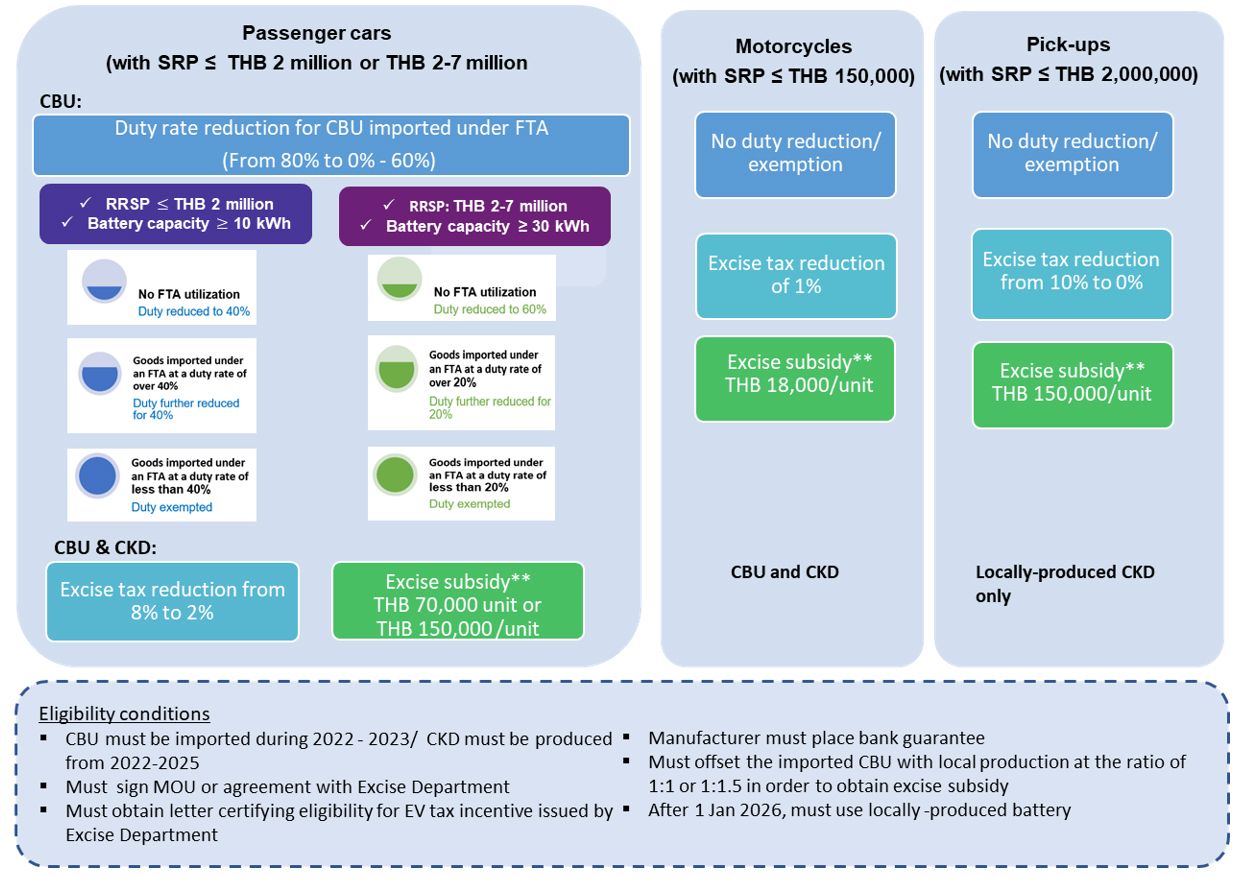

Thailand S Incentives For Electric Vehicles Ev Kpmg Thailand

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Here Are The Tax Reliefs M Sians Can Get Their Money Back For This 2018 World Of Buzz Tax Relief Income Tax

Should You Invest In Sspn Mypf My

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

The Economic Impact Of Conflicts And The Refugee Crisis In The Middle East And North Africa In Staff Discussion Notes Volume 2016 Issue 008 2016

North Carolina Providing Broad Based Tax Relief Grant Thornton

I Lindung 4 Key Points To Take Note When Using It To Boost Our Insurance Coverage Kclau Com

21 Tax Reliefs Malaysians Can Get Their Money Back For This 2019 World Of Buzz Relief Tax Money

Effects Of Income Tax Changes On Economic Growth

Should You Invest In Sspn Mypf My

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)